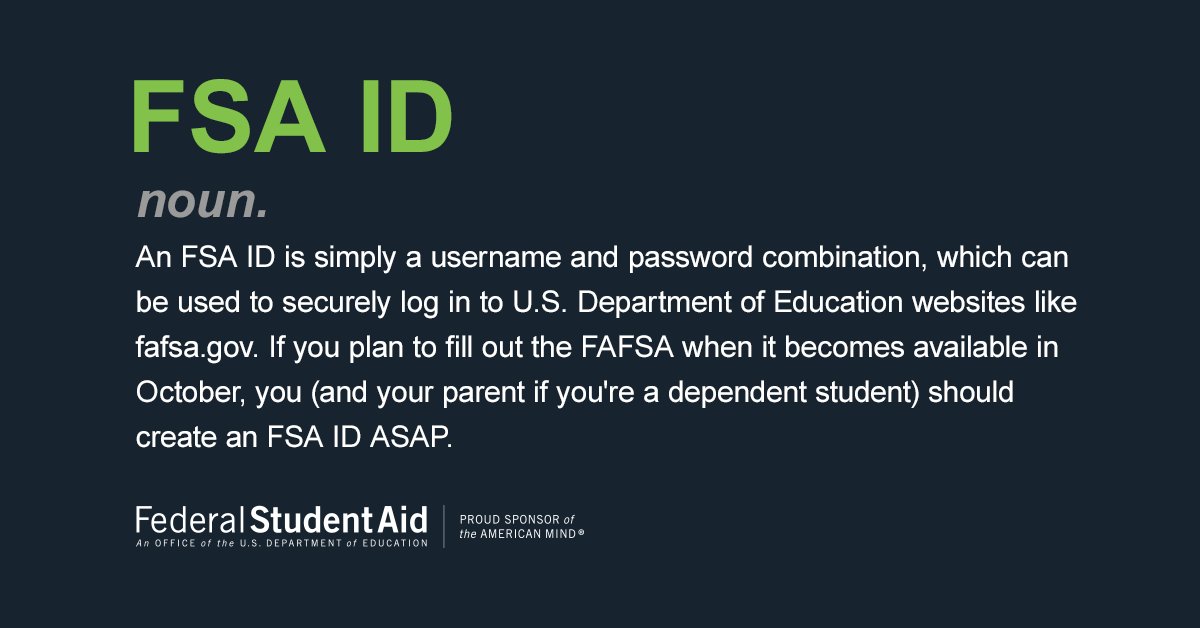

Direct Loans

Direct loans will be awarded to students who submit a FAFSA as part of their financial aid package. You may see two Direct loans. One is a subsidized loan, meaning the government is paying the interest while the student attends college at least half time, until they graduate. The subsidized loan will be $3,500 the freshman